Report: The state of sustainable news businesses

News publishers in our survey expressed guarded optimism

The State of Sustainable News Businesses report aims to provide a comprehensive overview of the current state and future prospects of news operations. By examining various aspects such as profitability, revenue streams, and emerging challenges, this report seeks to offer insights that can guide strategic decisions in the news industry.

To compile this report, The Rebooting surveyed 96 news publishers. We qualified these publishers as those whose primary business is “journalistic content,” as opposed to entertainment or lifestyle content (or other types of publishers). We supplemented this with stakeholder interviews.

Our findings show an industry under pressure yet many of our respondents expressed confidence in their own businesses. For example, the majority of respondents said their news businesses are profitable and four out of five expect expanded profitability in 2025. Similarly, 83% expressed confidence in their businesses.

This belies a macro environment filled with challenges, including steep referral traffic declines, shifting ad demand to performance marketing channels, advertiser wariness of appearing on news pages, and audience fatigue from what’s been a divisive and unpleasant series of news cycles over the last several years.

As Jay Rosen, an associate professor of journalism at New York University, points out, "We are living in a time when many of the subsidy systems that sustained public service journalism, and the news business as a whole, are falling out of alignment and failing to provide enough revenue to do the job the way it should be done."

This survey and report aim to shed light on these challenges and explore potential solutions. The research was conducted with support from Outbrain. Thanks to David Kaplan for contributing to this report.

The sky isn’t falling

Despite the doom and gloom around the news business, our survey showed a solid majority of respondents said their news operations are profitable.

Furthermore, 81% of respondents expect profitability to grow next year.

Our gut check of publishers revealed over 80% of respondents expressing some form of confidence: 34% of respondents are very or extremely confident about their businesses and 50% of respondents are somewhat confident.

This optimism, however, contrasts with broader industry trends. According to the Pew Research Center's 2023 report on the state of the news media, newspaper newsroom employment in the U.S. has fallen 70% since 2006, from about 74,000 jobs to about 22,000 in 2022.

To be sure, the confidence is tempered: Only 34% are either "extremely confident" or "very confident.”

This suggests that despite the challenges faced by the industry, many news organizations have found ways to maintain financial viability.

Lou Paskalis, CEO & Founder of AJL Advisory and longtime brand executive, paints a more dire picture: "I don't think there are any bright spots and I don't think there are any sustainable news models."

This discrepancy highlights the complex and varied landscape of the news industry, where some organizations are finding success while others struggle to survive.

A mixed view on advertising

There is a school of thought that the publishing business overall made a fateful decision in the early internet by embracing the notion that “content should be free.” The transition to digital business models, with exceptions like The New York Times, has been an unmitigated disaster for the news industry, particularly newspapers.

On average our respondents pegged advertising as 50% of their businesses.

The health of their ad businesses varied. Overall, 44% of news operations rate their advertising business performance as "excellent" or "good.” This tracks with the rebound many publishers have reported in the second half of the year, and in particular after a rough 2023 that saw a marked pullback in many publisher businesses.

Yet the good times are not universal, as shown by the 35% that describe their advertising business as "challenged.” According to an analysis done by Paskalis, from 2005 to 2020, there was an 88% decline in advertising spending on news publishers.

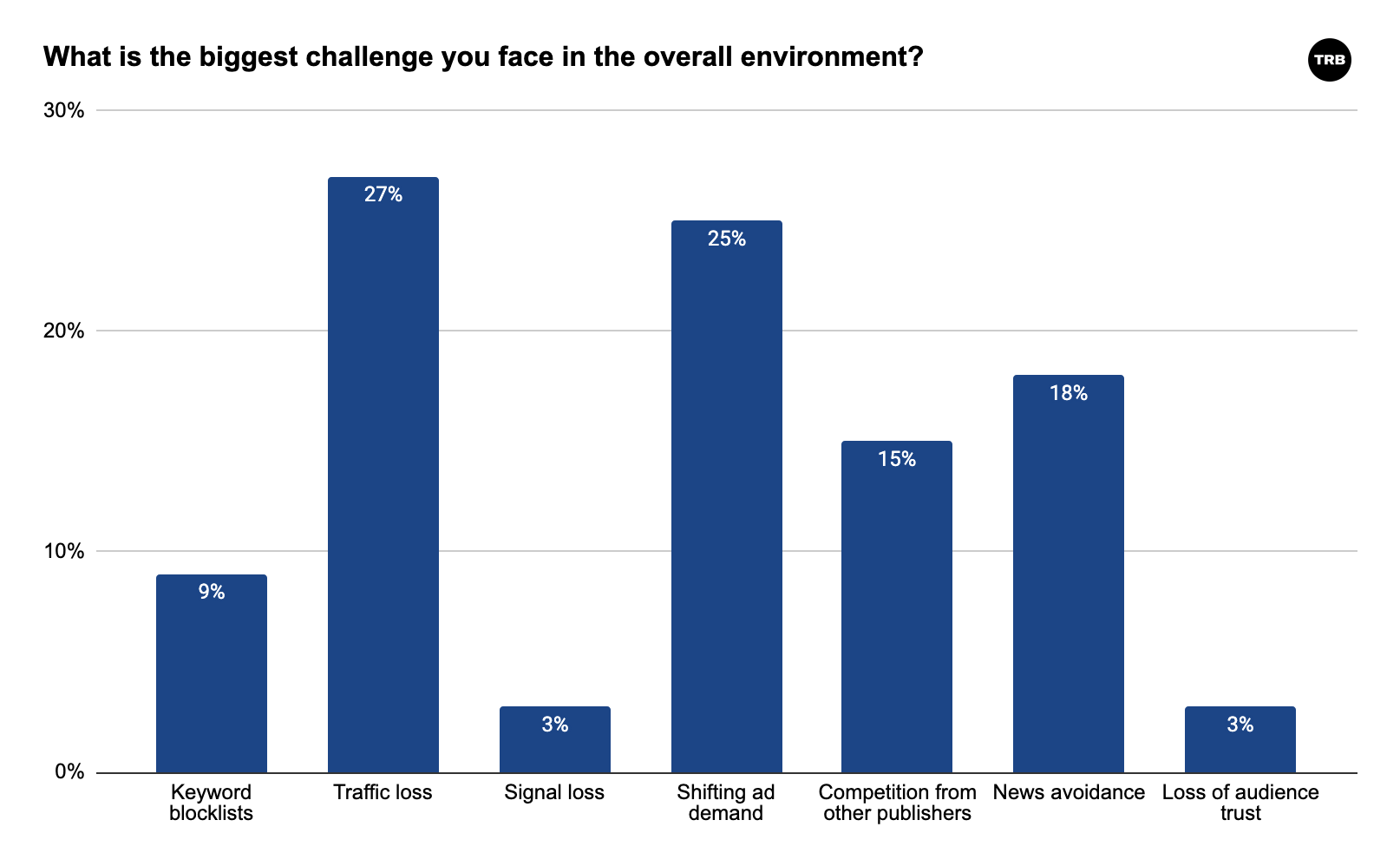

The challenges publishers face in their advertising business are varied. Our survey asked respondents to identify their key challenges among a list of the most common challenges to the news business – keyword blocklists, budget shifts to performance, competition from platforms and from other publishers, signal loss and loss of audience trust – but nearly a third of respondents identified other challenges, with many around meeting advertiser expectations.

The most common challenge chosen was the loss of traffic, followed by “shifting ad demand.” Notably, keyword blocking was not in the top four challenges.

This tracks with a structural shift to the ad market. Advertisers have decisively shifted to performance marketing. The rise of retail media is a case in point. It is now upwards to 20% of overall ad spending from a rounding error a few years ago, as most major retailers stand up advertising business that tap into their deep troves of customer and purchase data.

For all the drama over the loss of the third-party cookie and signal loss, few publishers identified it as their biggest challenge. The ham-handed implementation of “brand safety” – one respondent made sure to include the quotes in a verbatim – is another pain point. But respondents identified an overall shift in advertiser priorities, no matter what they might porcelain at industry conferences. In short, advertisers do not believe that the real or perceived risks of advertising on news are worth it.

One major news company CRO said many of the CMOs they speak to expressed surprise when told they block ads from appearing on the news publisher because of brand safety. This has been a regular refrain, but ultimately only advertisers can force change. This is far trickier at a time when the meme has gone from how the average CMO tenure is just 18 months to the entire CMO function being eliminated at major companies like UPS and Walgreens.

"Buyers should be buying [news] by the dump truck. But they're staying away from it because the decision calculus has moved. It's moved from the media buyer and even the marketing function to corporate communications."

Publishers have much work to be done on their own. Buying from news publishers is often a far harder proposition than big platforms. The lack of self-serve options has greatly narrowed the addressable market for publishers. This is particularly acute on the local news level, according to Paskalis. "Part of the problem that I discovered last year is that virtually none of them have a programmatic tech stack,” he said. This technological gap puts local news at a significant disadvantage in competing for digital advertising dollars.

Diversification is often a synonym for subscriptions

The structural challenges of the ad market have caused many news publishers to focus on building their subscription businesses. Nearly 80% of our respondents said they offered subscriptions. 72% of respondents that have subscriptions said their programs met or exceeded expectations. This indicates that subscriptions are becoming an increasingly viable revenue stream for news operations.

Subscriptions were far and away the most popular response when publishers were asked which area of their business showed the most promise. 50% of respondents identified subscriptions as the most promising line of business, far outstripping revenue sources like affiliate commerce and events.

The question around subscriptions is always around market saturation. According to the Reuters Institute For the Study of Journalism, 22% of Americans pay for news. According to an analysis done by Press Gazette, 11 news publications have over 1 million paying subscribers, with The New York Times setting the pace with 10.8 million.

A majority of respondents with subscription programs were pleased with the progress they have made with subscriptions.

"This subscription model works when you are a large platform like the New York Times, the Wall Street Journal,” said Paskalis. “But on a local level it's really hard to build a subscription model that's going to pay your bills."

Some publishers like The Washington Post are experimenting with more flexible payment approaches in order to broaden their customer base. Other publishers like The Guardian are leaning on voluntary payments. Local publishers like The Texas Tribune have found success with a diverse membership approach that combines corporate subscriptions with voluntary contributions, foundation grants and other revenue sources.

"We need to think clearly about and develop our imagination around subsidy systems well beyond the familiar ones of advertising and subscription,” Rosen said. “This is why I spent four years researching and talking about membership models."

Publishers may look back wistfully on the Trump bump they realized when Donald Trump arrived on the political scene, but they are not banking on a sequel. 63% said they expect the presidential election to have a neutral impact on their businesses.

Fear and cautious optimism in AI

At The Rebooting’s private dinners, conversation usually shifts to AI. And I’ve noted that it has often revolved around fear. The fear of a further erosion of search traffic as the 10 blue links era ends, the fear that AI platforms will wreck profitable side businesses like affiliate content, and the general discomfort with the notion that AI will compress an already hard-hit industry even further.

The New York Times sued OpenAI and Microsoft for its use of NYT content for AI training. Forbes detailed how AI “answer engine” Perplexity copied its paywalled content, leading to a threatened lawsuit in June. But most publishers have recognized they do not have much leverage and instead cut deals, often over employee objections.

Those concerns were expressed in our survey, only many publishers chose to take a glass half full view of AI, saying 34% saying they expect it to have a positive impact vs 30% expecting a negative impact. Most respondents sensibly settled in the middle, opting for “neutral.”

On the upside, respondents were most bullish on applying AI to their internal operations to drive efficiency. This is a story rippling through the entire economy, as the AI gold rush causes companies to scramble to apply it to their existing operations. AI is already at work at many, if not most, publishers, being used to take care of non-journalistic functions or at most those adjacent. Few reputable publishers have turned to AI to create content. Those that have quickly backtracked.

Publishers also see the potential for AI-driven personalization and also the ability to create new products. The New York Times, for example, brought on former Quartz CEO Zach Seward to lead its newsroom AI initiative.

On the downside, publishers rightly have concerns that AI will further erode traffic to their site, and most still need that traffic to make money. News publishers have already seen traffic declines due to Facebook deprioritizing news content and Google’s shifting search algorithm. Overall platforms have kept more traffic in their own ecosystems, and publishers typically only get a fraction of their traffic from direct navigation. That has led to over a third of respondents reporting they were blocking AI crawlers.

49% said further declines in search referrals were the biggest potential downside of AI, with 23% concerned about meeting changed consumer expectations. 22% said IP theft was the biggest downside.

The way forward

I tend to use the analogy of healthcare in the United States when imagining a healthy, sustainable news ecosystem. State support isn’t likely, outside of a hodgepodge of efforts on the state and federal level.

The giant tech platforms are mostly finished with news. Facebook has deprioritized news after being hauled before Congress and regularly accused of swinging the 2016 election. Google is under more threat than ever. The perils facing the news industry are a subset of the challenges facing the open internet overall. And with the shift to AI and regulatory pressure, Google’s role as the arbiter of the open web is at risk. While some may cheer that development, the old saw remains applicable: Be careful what you wish for.

There is no silver bullet to solving all the challenges. Subscriptions offer the promise of more stable models that are aligned with audience interests, yet according to the Reuters Institute, 56% of Americans say they won’t pay for news at any price. And even The New York Times converts less than 10% of its audience. There’s a need for more diversity in models that offer value exchanges personalized to different audiences.

The big hope of AI, beyond efficiency, is around personalization. News publishers will need to adapt their experiences to capture interest, much less subscriptions, from younger generations used to the algorithmic personalization of Instagram and TikTok.

While the news industry is challenged, news of all kinds is flourishing. Joshi Hermann has expanded a set of local news newsletters in the United Kingdom. News commentary delivered through newsletters, podcasts, TikTok and YouTube are thriving. Niche news, particularly in business and passion areas, is doing just fine.

Instead of looking for a single answer, the progress to a sustainable news ecosystem will end up as a patchwork of approaches that mix nonprofit and for-profit models, and a variety of revenue models, even if the balance will continue to shift to subscriptions and other non-advertising streams. As shown by our research, AI looms not so much as a threat, but as an opportunity for news publishers to adapt to a more-with-less era and focus scarce resources on what matters most: on-the-ground journalism that enlightens citizens while generating profits.