Sweat equity

Anonymous digital media exec on the busted lottery tickets of the scale era

In today's newsletter:

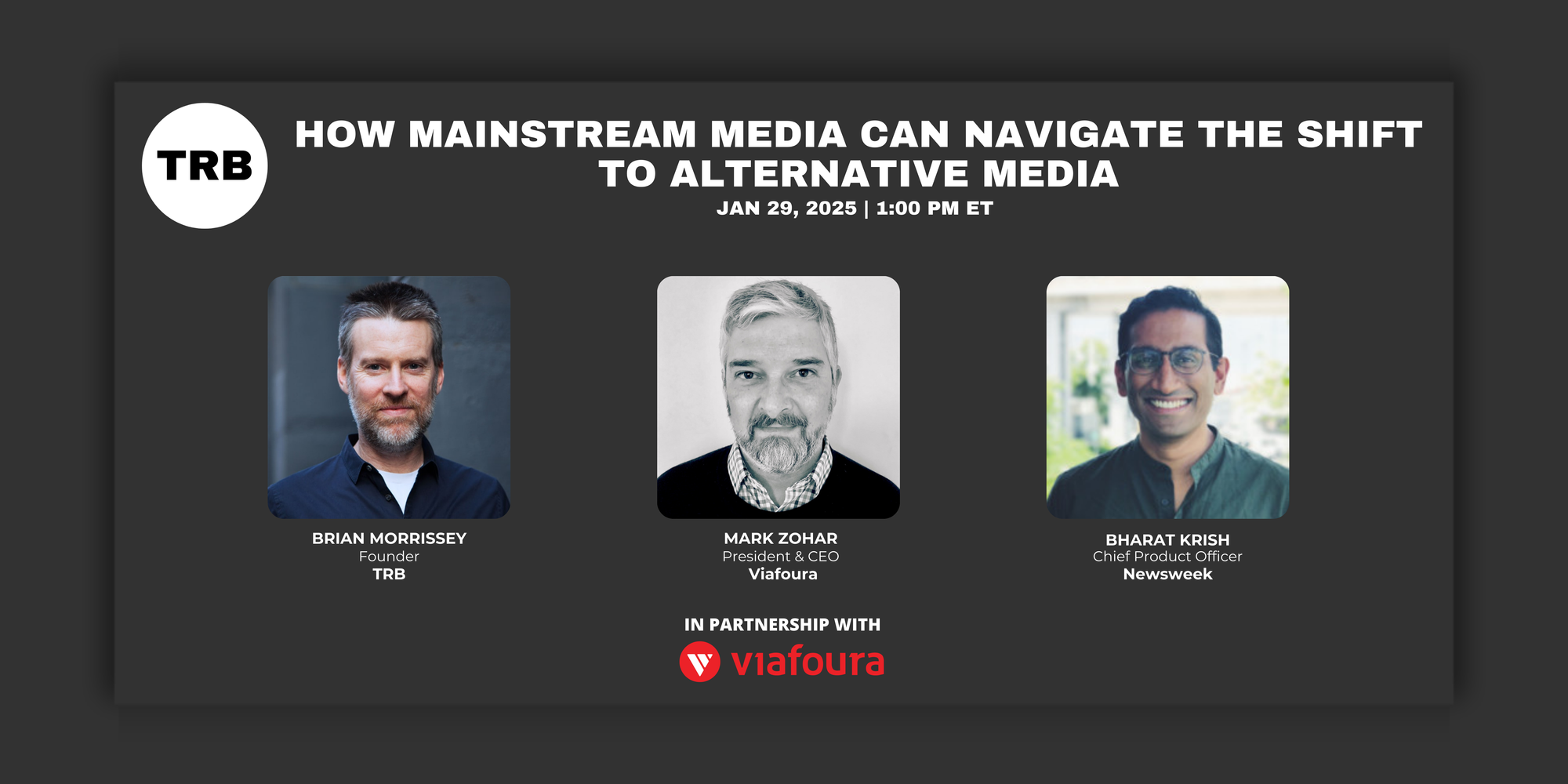

- The Rebooting's upcoming online forum features Newsweek chief product officer Bharat Krish and ViaFoura CEO Mark Zohar on competing with alternative media

- How agentic AI will change publisher subscriptions

- Feedback on BHAGs

- Anonymous digital media executive on the lottery tickets of the scale era

Institutional media is fighting an asymmetric battle with alternative media. The advantages of scale can act as drags, as higher standards lead to added costs and slower action. In The Rebooting’s next Online Forum, I’ll be joined by Newsweek chief product officer Bharat Krish and ViaFoura CEO Mark Zohar to discuss how publishers are retooling their product approaches to be more nimble and responsive to audience needs while increasing trust and direct ties. Among the topics we’ll cover:

- Changed distribution strategies

- How Newsweek uses AI to efficiently build audience scale

- Using AI to build personalization (and drive incremental revenue)

The Online Forum is on Wednesday, January 29 from 1pmET to 2pmET. If you can’t make it live, registrants will get a link to the replay afterwards.

When AI meets subscriptions

Last night, The Rebooting held its first private dinner of the year, a gathering of subscriptions executives that was sponsored by Zuora. We talked about how the influx of AI is affecting subscription strategies. Some key talking points:

- AI paywalls require faith. Hard paywalls and meters are giving way to dynamic paywalls that use a variety of propensity models to decide which users are ripe for a subscription – and when to block them.

- Price discrimination isn’t a user issue. I’ve heard a few times of unease to use dynamic paywalls to offer different pricing to users. The reality is that few people complain about prices changing since that’s become the norm with many products.

- AI’s biggest impact might be on retention. AI is good at sorting through a mass of data to identify signals. While much of the focus of AI in subscriptions has been on acquisitions, the bigger opportunity could be in retention by understanding on a subscriber-level when usage patterns have shifted to flag them as a flight risk.

- AI will do more busy work. The more-with-less era means subscriptions teams need to be lean, and AI offers the opportunity to cover more ground.

- The future: agent negotiations. The current focus is on tactical uses of AI to optimize conversion and retention, but the influx of agentic AI means that within a few years users could have their own agents that go out to collect information and negotiate the price of paywalled content with publishers’ agents.

Thanks to Zuora for sponsoring the dinner. If you’re interested in participating in a future dinners and other TRB events, fill out this form.

Feedback: Mission statements miss the point

On Tuesday, I wrote about The Washington Post’s new mission statement – “riveting storytelling for all of America” – and its BHAG of 200 million paying subscribers. The Post has clarified that, contrary to what the Times reported, its goal is 200 million users. Phew. This could reignite the short-lived ComScore Wars of 2015, when the Post topped the NYT with 71 million uniques to 69 million.

A veteran digital media executive wrote to me to detail why these exercises not only miss the point but highlight a blind spot at many publishers.

“The thing is, no one cares about what The Post's BHAG is. It's an inward-out perspective. Media companies tend to put themselves on the pedestal, but consumers can care less. Media companies should keep their mission consistent (the why), and iterate on the how. Any time a media company (and to be fair, any company) changes their mission (or spend another cycle on rebranding), unless the updated mission objectively better serves their consumer base, it's all but an empty hoopla, unmet promise, and a whole lot of unnecessary meetings and memos.

What media companies should focus on, is to make them worth reading/listening to/watching again. The world needs more thoughtful analysis and less beat-by-beat news. It is the analysis that is valuable, that helps us interpret the world events, rather than simply knowing something happened.”

This is a great point. These kinds of corporate exercises tend to veer into Office Space territory. I have real sympathy for bosses that need to sell this kind of stuff to newsrooms that are allergic to corporate sloganeering by instinct and professional necessity. Most of what’s needed is the boring but objectively difficult task of reorienting all aspects of the business to focus on the audience.

Send me your feedback to bmorissey@therebooting.com or by hitting reply to this email.

Anonymous digital media exec on the dangers of sweat equity

I asked a longtime digital media exec to tell their story about a generation of accumulating equity in digital media companies during the scale era – and how 15 stakes netted $30,000.

After working for a big, storied, multi-brand publishing company in the late aughts, I decided that a full-time job in big media wasn’t for me. I was much more entrepreneurial than a 90-year-old multinational corporation grounded in print could support (or withstand), so I decided to make a career out of digital media.

I often structured my consulting fees as part cash and part equity, and in the case of my advising roles, as all equity. I knew that digital media was a risky business, and that few had walked away wealthy from their equity, but I figured that through the diversification that came from having equity in 15-plus companies I believed in, I would end up with at least one or two decent-sized successes. I even joined a couple of early-stage, promising media companies with visionary leadership in full-time, senior management roles - again, willing to sacrifice significant short-term cash for what I expected would be either modest or significant payouts in the future.

The cash portions of my engagements were enough to support my life in NYC and save some money for retirement, but I was always banking on making at least a few hundred thousand dollars down the line that would brighten my financial picture and offer me more flexibility in my future career endeavors.

How foolish in retrospect.

My “sweat equity” strategy didn’t work for me or for most of the people I know who made a career in digital media taking lower cash compensation in the hopes of an eventual equity reward. Tight margins, imperfect business models, and distribution that was largely at the whims of social media, search, and even email deliverability algorithms led to almost all of my “investments” being acquired for either less money than they raised, or for just enough money to pay back their investors and provide a modest payout for their founders.

My equity in 14 of those companies, including the two where I held full-time senior management roles, netted me nothing. The one company I worked for that had a decent exit had done so many rounds of fundraising after my equity had been issued that I walked away with $30,000 before taxes: a nice bonus, but nowhere near what I hoped would be possible.

And I consider myself to be lucky. I have many friends who worked at one company for 5-10 years, and gave their hearts and souls for less cash compensation than their big media peers were making, with the expectation that a healthy, fully-vested options package would net them a healthy payout, only to walk away with nothing.

Stock options are a nice perk as part of an overall compensation package, but you should never count on them - especially at early stage companies and especially in digital media.

Send me a note if you want to participate in this series, anonymously or not.

Send me your feedback by hitting reply or emailing me directly at bmorrissey@therebooting.com.