The rebundling

Veteran media exec Joe Marchese sees the pendulum swinging

Hope everyone’s July is off to a good start. If you aren’t already a subscriber, please sign up to receive The Rebooting twice a week, every Tuesday and Thursday.

This week:

- On The Rebooting Show, I spoke to Joe Marchese, executive chairman of Human Ventures and longtime media executive. Joe has a useful reminder that boiling all advertising down to performance marketing is a mistake and misunderstands the point of building brands.

- The vogue for newsletters to add investing as a business model

- Why you should check out Napkin Math

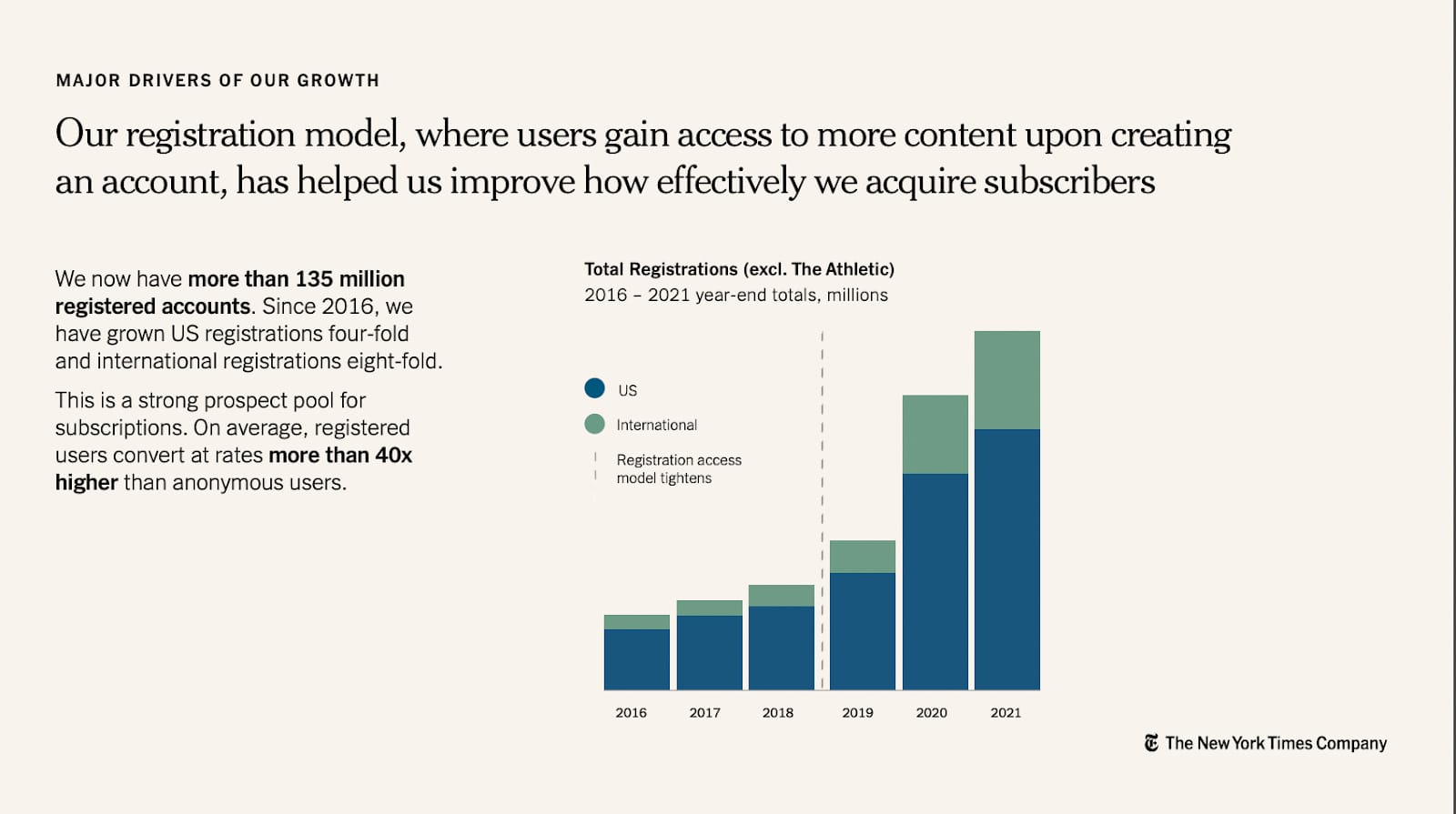

- The NYT’s registered 135 million users

First, a message from The Rebooting’s presenting sponsor, Bombora.

With the third-party cookie on the way out, publishers are scrambling to understand more about their audiences. That focus on first-party data, while important, is only one piece of the puzzle, since most publishers count 70% or more of their audience as unknown. Enter Bombora, which works across over 5,000 business-to-business websites to identify high value prospects and understand what they’re in the market for buying. The Bombora data co-op allows publishers to tap into this valuable intent data, in a privacy-safe way, as part of a comprehensive data transformation strategy. Learn more about how Bombora partners with publishers to use intent data to improve monetization.

Long live the bundle

The pendulum always swings. Media regularly oscillates between periods of bundling and periods of unbundling. Bundles tend to rub people the wrong way because they feel they pay for stuff they don’t want. The downside is unbundling can be a complete hassle and the supposed savings quickly evaporate. Just look at what you’re paying now for various streaming services (themselves mini-bundles) instead of cable service. Inevitably, whether it’s the proliferation of newsletters or the many streaming products, we’ll see rebundling take off.

“The bundle was the absolute worst form of entertainment delivery, except for every other one,” said Human Ventures executive chairman Joe Marchese on this week’s episode of The Rebooting Show. “Consumers are looking for a rebundle and these streamers are gonna have some sort of rebundle coming. News and Substack has some sort of rebundle coming. Everything that's old is gonna be new again over the next couple of months.”

Joe is a longtime media exec who has operated on many sides of the business, from starting a tech company with SocialVibe, later True X, to being on the TV side as president of Advanced Advertising Products at Fox Networks Group. (He’s also a tequila entrepreneur as a part-owner of Komos.) A few things that stood out from our conversation, which – and I’m biased here – you should listen to in its entirety:

- Media is often a terrible standalone business but is good support for other businesses. The TV business is now dominated by tech companies, a trend likely to continue. That isn’t particularly new. “Media has historically been owned by non-media businesses,” Joe notes, going back to early radio and then cable systems owning TV networks. “The business of media has outsized influence but undersized monetization.” The result: “I don’t know the media business works at scale without alternative models.”

- The permission to curate is powerful. In a world of near-infinite media choices, people need some way to make sense of what’s good and what’s bad. That’s where trust comes into play. People can turn to algorithms like Google’s or Facebook’s to make sense of what’s important to them, or they can turn to publishing brands and individual brands. “Brands matter for the curation of goods and services so that people don't have the paralysis of infinite choice,” Joe said.

- Not everything is performance advertising. With ample data, sophisticated targeting and analytics, it can sometimes seem that brand advertising is an anachronism as the media world shifts firmly to “performance advertising,” or what used to be known as direct response. It’s no surprise, after all, that possibly the fastest growing segment of digital advertising is retail media, because it has purchase data to drive incremental sales. That myopic focus on the bottom of the funnel often misses what advertising has always been good at doing: Aligning brands with those creating culture. That doesn’t show up on a spreadsheet, but it’s always been a major economic value that advertising has produced. “In a world where we have dynamic targeting and we know what each household is watching, the advertising experience is actually worse,” Joe said. “How did we get worse at advertising in a CTV advertising environment than broadcast television 40 years ago?”

Check out The Rebooting Show for my full discussion with Joe – and a chat I had with Steve Lilly, svp of global data partnerships at Bomboar, about how publishers should be preparing for the end of the third-party cookie. You can listen on Apple, Spotify or Anchor.

The newsletter investor class

Newsletter business models are growing more diverse. Substack popularized the streamlined model that relied fully on subs. But the best way of making money is many ways, and having a high-value audience provides many different ways of translating that into money. More newsletters are turning to investing as a key part of their monetization stack. The approach varies, but the typical tack is to assemble a big and valuable audience and then use that influence to scout deals (and invariably then promote the portfolio companies). It’s a path taken by Tim Ferris, Anthony Pompliano and Packy McCormick. Workweek has added a fun as part of its model. Mario Gabriele of The Generalist this weekend announced a $12.5 million fund. I’m interested to see how these funds do since the long bull market made a lot of investors look smarter than they actually are – and the recent downturn is probably make them look dumber than they are. Like commerce, I believe there are approaches that look better on paper than in reality, since managing a portfolio likely requires a different skillset than building a small publishing brand. For instance, Not Boring focuses on web3, but its fund will be looking at deals in… the defense sector? I’d be interested to know if others think this is a broadly promising trend or likely to end badly for most.

Check out Every’s Napkin Math

Every is a writer collective that’s occupying the middle ground between solo creators and institutional brand. Napkin Math is one of their top newsletters, written by Evan Armstrong, focused on business strategy. Check out this recent post Evan wrote breaking down why TikTok scares Facebook so much. Hint: At the scale of Meta, it truly is competing with anything that garners a substantial amount of human attention.

The New York Times’ first-party data strategy

Subscriptions are the North Star goal for The New York Times, but focusing on the 8 million subscriptions it has sold sometimes glosses over how it got there. The funnel matters. And the middle of the funnel for subscription products in publishing is almost always some kind of registration data. Worth checking out the Times’ recent investor presentation – thanks to Shane O’Leary for highlighting – in particular the section on how the NYT built a registration base of 135 million that feeds its subscription efforts and makes its advertising more valuable. The bottom of the funnel is great, but better not neglect the middle.

Thanks for reading. Send me a note with feedback and ideas for future podcast episodes: bmorrissey@gmail.com. Thanks to Andrew Chang, who shared last week’s newsletter about toxic positivity: “I've found that there's room for critical/negative viewpoints in business settings and for those who do voice those opinions are viewed in a negative light. It creates little incentive for honesty and truth seeking - which ultimately leads to delusion.” Thanks, Andrew.