The state of subscriptions

The Rebooting's new research shows maturation

Today, I’m releasing The Rebooting’s second research project. With partnership from BlueConic, I surveyed over 200 publishers to understand the progress they’ve made with subscriptions. What emerged was a picture of a maturing business that’s past the “numbers go up” phase and onto the hard work of building sustainability and resilience. You can get the full report here.

Subscriptions are a forever business

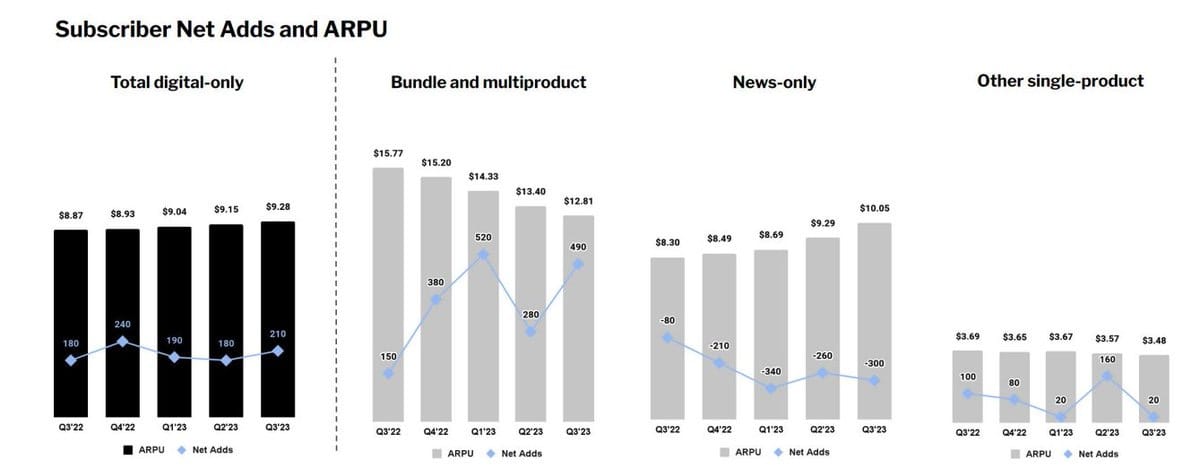

Yesterday, The New York Times reported hitting a remarkable milestone: It now has 10 million subscribers, with an eye on 15 million by 2027 with its reader revenue growing at a 16% clip from the year-ago period..

This is a stunning success for a business model pivot dating back to March 2011, when it first began its subscriptions journey with an easily circumvented paywall. At the time, the Times was just emerging from the lowest point in its history, when its survival was in question as it grappled with a transition from print. It’s hard to remember now, but the smart money was on the Times as a legacy brand in terminal decline.

The Times has become something of the exception to the rule, or at least the model student. Its strength is in stark contrast to the stalled subscriptions growth at The Washington Post, once thought a credible rival to the Times, which has shed 15% of digital subscribers from 2021 to October 2023 and is on track to lose $100 million this year, despite being owned for the last decade by one of the greatest business innovators of recent times.

My go-to analogy of the publishing business is a children’s soccer game. When the ball goes to one part of the field, a clump if kids surround it. It goes to another part of the field, the clump follows. The same pattern seen with SEO or video or commerce has happened with subscriptions, as publishers have looked to replicate the Times success. Even Condé Nast is pinning its future strategy on subscriptions (and commerce).

The question remains when we will hit peak subscriptions. The recurring revenue model is nearly too attractive. The market is not limitless for subscriptions, particularly of news. In fact, the Times has achieved its success by morphing its strategy from a paywall for news articles to a multifaceted news and lifestyle bundle that’s future growth is more reliant on finding the next Wordle than the work of the Baghdad bureau.

That’s a tacit acknowledgment that the subscriptions business is maturing. The Rebooting conducted a survey of 201 publishers in October 2023 to find the state of publisher subscription programs. The research shows that the heady days of subscription programs with rocket ship growth are in the past. The market has matured, and the name of the game is increasingly turning to retention – see the Post for a cautionary tale of what a churn spiral looks like – and wringing more money out of subscribers, even as they still need to fill the top of the funnel with discount offers.

A few highlights of the research report:

Publishers see diversification as the top goal of subscriptions. The research showed publishers are seeking a healthy balance in their businesses. The clear top priority was to diversify revenue, followed by the need to understand their audiences better.

Subscription businesses are maturing. We found was only a minority were still in hyper-growth mode of over 20% growth. Instead, most publishers are seeing modest growth in subscription revenue, with the most common growth rate (30%) being under 10%. That’s a natural evolution, as subscriptions become what BlueConic’s Patrick Crane calls a “forever business.”

Filling the bucket is still top priority. The biggest challenge identified by publishers was increasing their overall number of subscribers, with churn as the second biggest challenge.

Churn is a looming focus. While getting new subscribers ranked as a top priority, churn was tabbed as the top looming trend in subscriptions. Inevitably, the maturation of these businesses mean that the focus will shift from top line growth to driving higher revenue per subscriber, as the Times is doing with its bundle strategy.

Publishers are mostly neutral about the success of their subscription programs. There are no silver bullets in media. It’s all hard. Subscriptions are no different. A slim majority (52%) said they were either neutral or dissatisfied with their subscriptions progress.

Jeff Selingo spent eight years at the Chronicle of Higher Education, serving as editor in chief and editorial director, before setting off on his own path that combines an academic posting, a nano-publishing operation, book writing and more. Jeff and I have traded notes on the independent path over the years, and I wanted to have him on The Rebooting Show to discuss what we’ve both learned on the independent path. We discuss the transition from editorial to sales, why treating “lifestyle business” as a pejorative is strange, and fighting the pull to rebuild what you left behind. Check out the full conversation on Apple, Spotify or wherever you get your podcasts.

Do brand still matter?

One more podcast. On this week’s People vs Algorithms, I had separate conversations with Troy and Alex because of time zone challenges. Both revolved around whether the power of brands is on the decline, and how AI could accelerate the erosion of flimsy brands that don’t mean much to many, even if people pretend otherwise. You can get the full podcast on Apple, Spotify or wherever you get your podcasts.

Thanks for reading. I’m going to have more on the twilight of the brands on Monday because I got a lot of good feedback, and thoughtful critiques. I always welcome your feedback. Just hit reply to send it.